In a year defined by global uncertainty—wars in Eastern Europe and the Middle East, rising U.S.-China tensions, and a shift in U.S. leadership signaling major policy changes—the world's best-performing stock markets weren't to be found among the usual safe havens.

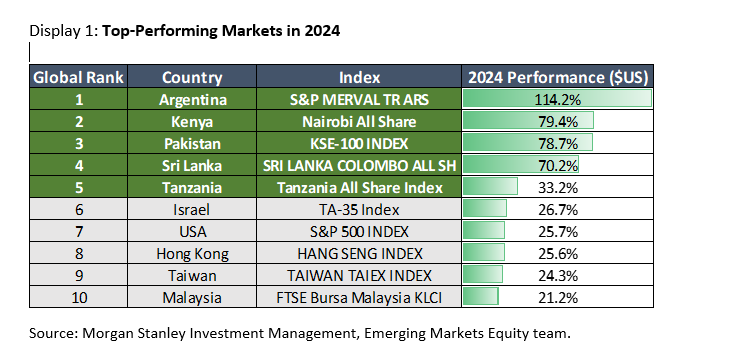

Rather, the five best-performing markets globally in 2024 belonged to the often-overlooked frontier and small emerging markets: Argentina +114% in U.S. dollar terms, Kenya +79%, Pakistan +79%, Sri Lanka +70% and Tanzania +33%.

Each of these markets benefited from significant economic reform and historically low valuations. Going forward, they stand out as uncorrelated opportunities, isolated from global trade wars, and poised for accelerating gross domestic product (GDP) growth driven by recent reforms and strong domestic demand.

Reform, recovery and resurgence

Many frontier markets have experienced severe economic distress over the past year or two. Yet these crises have driven bold reforms, including slashing budget deficits, tightening monetary policy, and loosening currency controls. Countries like Argentina, Egypt, Nigeria, Pakistan, Sri Lanka and Turkey are now on a path to recovery, with a few being top-performing markets last year. We believe these countries, coupled with other high-growth economies like Vietnam and Bangladesh, set the stage for a resurgence in economic growth within the MSCI Frontier Markets index. Their GDP growth is expected to accelerate from 3.4% in 2024 to 4.1% in 2025 while emerging markets are expected to expand by 3.9% and developed markets are estimated to grow by 2.0%.

Escaping China and the tariff trap

Rising geopolitical tensions between Washington and Beijing have led many investors to scale back their exposure to the Chinese market.

While many large emerging markets remain highly exposed to China, many frontier economies, such as Egypt, Bangladesh, Pakistan, Nigeria and Turkey, exhibit much lower sensitivities to Chinese economic data, financial markets or renminbi (Chinese yuan) fluctuations.

These countries, except for Vietnam, are not in the direct crosshairs of trade wars, which helps insulate them from the impacts of tariffs. For example, trade accounts for only a third of GDP in countries like Egypt, Bangladesh, Argentina, Kenya and Pakistan. Frontier markets as a whole account for just 4.4% of global exports compared to 45.2% for emerging markets.

Although investors remain fixated on the tug-of-war between superpowers, the real beneficiaries of U.S. and China tensions are the overlooked middle powers—large, strategically important economies like Indonesia, Vietnam, Pakistan, Egypt, Morocco, Nigeria and Turkey. These countries are becoming battlegrounds for influence and are leveraging superpower rivalries to secure foreign capital for industrial expansion and critical infrastructure development. This influx of strategic investment could transform these middle powers into more resilient economies.

Demographics defying the gray wave

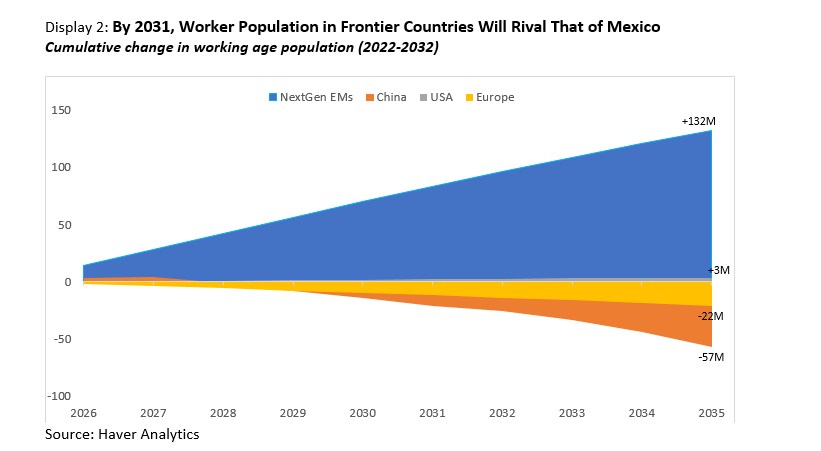

Many frontier markets will also benefit from the continued growth of their human capital. Last year marked the first time in modern history that working age populations declined in developed countries, a trend that will quicken in years ahead. For example, over the next decade, the European Union will lose more than 20 million people from its labor force, according to the United Nations population data.

China faces the same challenge, with an expected loss of nearly 60 million workers over the coming decade. However, over the same period, Vietnam, Indonesia, Philippines, Pakistan, Bangladesh, Egypt and Nigeria—home to a combined population of 1.3 billion—are set to add 132 million people collectively to their workforce, effectively creating another Mexico.

Homegrown heroes

As spending power grows in frontier markets, local brands are steadily capturing market share from global giants. While international brands still dominate aspirational categories, everyday consumer products are increasingly falling into the hands of nimble, homegrown competitors in categories such as groceries in the Middle East, pet food in Southeast Asia and cosmetics in Egypt.

E-commerce and food delivery platforms have leveled the playing field, eliminating the need for huge marketing budgets and massive distribution networks to stock retail shelf space.

For investors, this presents a potentially powerful, long-term opportunity to tap into emerging local brands that best understand their markets.

Bottom line: Frontier and small emerging markets are leveraging their youthful populations, rising foreign investment and relatively insulated domestic demand to ignite their economic growth on the back of recent reforms. Trading at historically low valuations, these markets offer global investors access to growth and diversification in ways that major markets cannot. For those willing to look, opportunities are often hiding in plain sight.